A discussion paper by Dr. Johannes Kotte & Oliver Meyer

Abstract

It is widely accepted that NFTs have significantly changed the market for digital assets. Previously, buying and selling digital assets such as images, audio and video files was mostly an unstandardized, sometimes offline process that often required third parties acting as agents. Today, NFTs are often used as digital certificates of authenticity. They ensure that among a multitude of potentially completely identical copies, only one file can be considered a signed original and hence are used to buy, own and sell digital assets. However, after a short and massive surge in 2021, the NFT market collapsed in 2022, displaying growth rates of around -90 percent (“surge-and-collapse”).

This discussion paper argues that – next to macroeconomic factors (war in Ukraine) and macro-societal (Covid-19 lockdowns) factors – deal fever and fraud are two main drivers behind the collapse and that the growth potential of the NFT market remains extraordinarily high, if these challenges can be mastered. Deal fever stems from buyers being driven by the fear of missing out on significant capital gains (“FOMO”), combined with the lack of structured information and communication about NFTs. This makes the market vulnerable to single news and hence high price and activity volatility. Fraud seems to be ubiquitous and has likely reduced the trust into the market.

While there have been innumerable technical innovations in the NFT space, these two challenges at least partly call for social innovation. In order to re-establish trust and prevent a second surge-and-collapse, a social corrective is required. This paper argues that collecting, generating, condensating and displaying reliable valuation-relevant data on a decentralized ledger of a democratic entity is to be the most promising way to do so. The NFT community should work on making this happen.

A view on the current state of the NFT space

NFTs and the ownership problem for digital assets

Essentially, an NFT is a securely transferable data storage, stored in a public ledger of a blockchain. For digital assets, NFTs are often used as digital certificates of authenticity. They ensure that among a multitude of potentially completely identical copies, only one file can be considered a signed original. They are used to buy, own and sell

- digital art work and collectibles (e.g., OpenSea, Rarible, SuperRare),

- gaming items and in-game assets (e.g., Helix, Illuvium),

- assets in the virtual world such as real estate (e.g., Roblox, Sandbox, Decentraland),

- music and other forms of digital media (e.g., SanSound, BandRoyalty),

- rights such as the right to access a premise or club (both real and virtual), or to execute a voting right (coachella, Azuki)

- certificates of authenticity and location of physical assets (BrickEstate, RedSwan, Realesto).(1)

It is widely accepted that NFTs have significantly changed the market for digital assets. As digital assets can be copied easily, quickly, infinitely, at low cost and without a loss in quality, it is impossible to tell apart the original and the copy – which in the past made it very hard to effectively and efficiently identify the owner of digital assets and transfer the ownership.(2) Of course, intellectual property laws know property rights also for digital assets, including ways to transfer and enforce them (including copyrights, which are typically not included in NFTs(3)). But this is mostly an unstandardized, sometimes offline process and often requires agents such as marketers or lawyers. On top of that, possession of digital assets is very easy to obtain and almost bears the same fruits as ownership itself. Hence, ownership rights were hard to be secured and transferred effectively. As markets can’t operate without clear property rights and the ability to enforce them, markets for digital assets tend to struggle to operate efficiently and at scale.(4)

Software companies solved the problem by selling hardware (CDs), requiring user codes and delivering software as a service. Gaming companies sell digital assets that only function in their own controlled environment: the game. For digital art and collectibles, NFTs were the solution: “In doing so, they make it possible to build markets around new types of transactions – buying and selling products that could never be sold before, or enabling transactions to happen in innovative ways that are more efficient and valuable.”(5) NFTs sought to empower digital creators to effectively own and monetize their artwork and cultivate their communities directly, without interference from agents.(6) This is directly obvious in the markets for digital art and collectibles, but also in the gaming industry. Due to the wake of various metaverses, creating and selling digital assets has become a vibrant business.(7)

(1) ResearchGate

(2) OneArtNation, Harvard Business Review

(3) SocialSamosa

(4) Harvard Business Review

(5) ibidem

(6) Vulcan Post, NFTnow, OneArtNation

(7) Cointelegraph

The NFT trading surge-and-collapse in 2021-22

Depending on whether one considers ‘Colored coins’ by Meni Rosenfeld, Vitalik Buterin and Yoni Assia or ‘Quantum’ by Kevin McKoy as the first ones, minting NFTs started in 2012 or 2014 respectively. The NFT market has seen tremendous growth ever since. It peaked in late 2021 when the number of sales and active wallets hit all-time highs.(8) Various NFTs sold for unprecedented prices, sometimes in the millions of USD(9), even on well reputed platforms like Christie’s and Sotheby’s.(10)

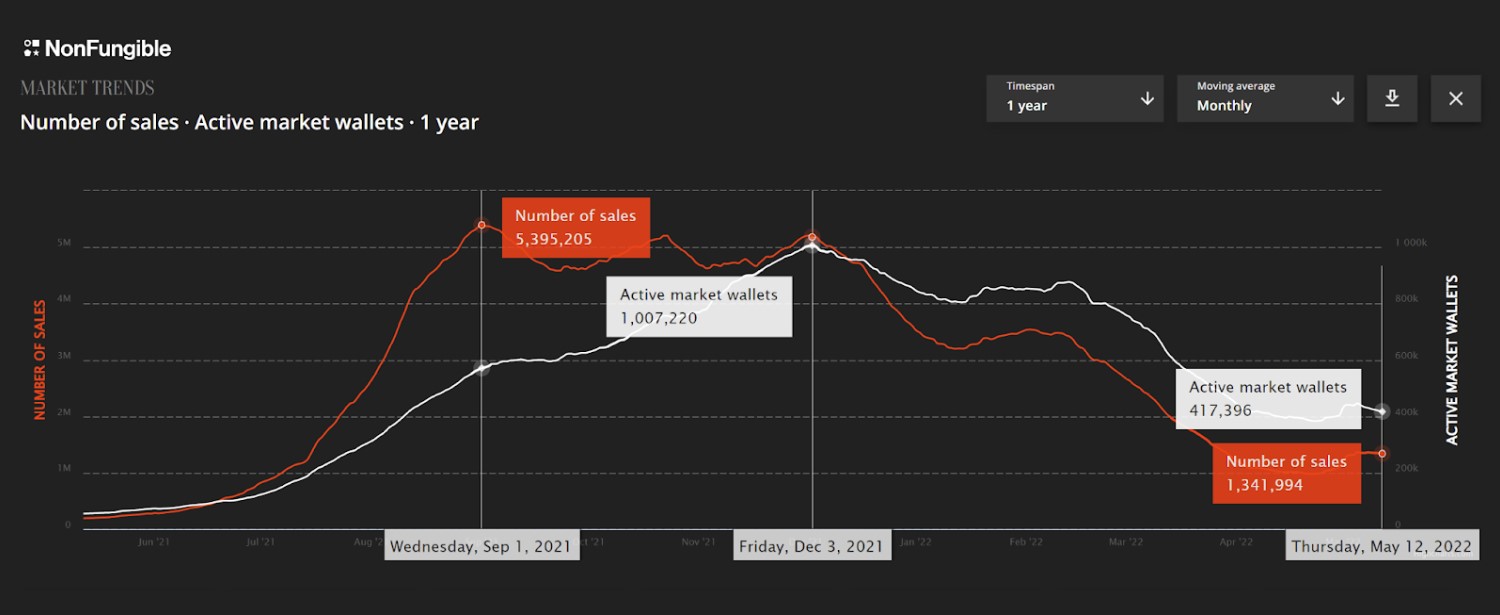

Half a year later, however, the number of monthly sales went from almost 5.4m on Sep 1, 2021 to 1.3m on May 12, 2022 (-75 percent) and the number of monthly active market wallets had gone from over 1m in December 2021 to little over 400,000 in May 2022 (-59 percent).(11)

Graph 1: Number of NFT sales and active wallets trading NFTs 13 May 2021 – 12 May 2022.

Source: Graph by NonFungible, obtained from Vulcan Post (retrieved 5 April 2023)

A report by Protos from June 2021 supports this, showing that the number of NFT transactions on Ethereum dropped by over 90 percent between May and September 2021.(12)

(8) Vulcan Post, NonFungible

(9) NFTnow, ChainWitcher

(10) Christie’s, Sotheby’s

(11) Graph by NonFungible, obtained from Vulcan Post

(12) Protos

Potentially further fueled by the collapses of Terra Luna in May 2022(13) and FTX in November 2022,(14) this trend has continued to this day: Current data by NonFungible(15) shows that the number of monthly sales went down to 333,521 (-94 percent compared to Sep 1, 2021) and the number of monthly active wallets went down to 129,670 (-87 percent compared to Dec 3, 2021). The global number of unique buyers has even gone down to 86,798. Even though the monthly trading volume is still at a considerable volume of roughly 467m USD (coming from over 4bn USD in September 2021), it is fair to say that the market for NFTs imploded.

(13) BBC

(14) Forbes

(15) NonFungible

Graph 2: Number of NFT sales and NFT Sales volume NFTs 6 Apr 2022 – 5 Apr 2023.

Source: Graph by NonFungible (retrieved 5 April 2023)

Graph 3: Number of NFT sales and active market wallets 30 Mar 2023 – 5 Apr 2023.

Source: Graph by NonFungible (retrieved 5 April 2023)

While the development has not been identical across all segments, all of them were affected, as can be seen from the comparison of the segment-specific graphs:

Graph 4: Number of NFT sales and NFT sales volume 6 Apr 2022 – 5 Apr 2023.

Source: Graph by NonFungible (retrieved 5 April 2023)

| ART | |

| COLLEC- TIBLES | |

| GAMING | |

| META- VERSE | |

| UTILITY |

Accordingly, the general interest in NFTs has fallen sharply, as indicated by a 90 percent decline in Google searches for “NFT” since its peak in calendar week 4 of 2022 (=100).(16) Meta even pulled out of NFTs completely in March 2023.(17)

(16) Google Trends

(17) The Verge

Graph 5: Interest in the search term “NFT” over time

Source: Graph by Google Trends

Reasons for the 2022 NFT trading collapse

Overview

Despite all the bad news, there are positive indicators as well: After ebay entered the NFT space in 2021(18) and offered its first NFT collection in May 2022,(19) Amazon announced in January 2023 to enter the NFT arena.(20) Hence, two of the biggest ecommerce players seem to double down on the market. Furthermore, some analysts expect a significant increase in market size over the coming years – even after the steep downward trend of the world economy and NFT market was in full swing: End of May 2022, SkyQuest Technology expected the NFT Market to reach a value of 122 bn USD by 2028, implying a CAGR of over 34 percent from 2022 to 2028.(21) In June 2022, Research and Markets forecasted a 35 percent CAGR (4.5x) 2022-27 of the NFT market.(22) Given that the market collapsed by about 90 percent, a growth of 4.5x would mean that almost half of that loss would be recuperated in the next 4 to 5 years.

Is this possible? And if yes, what needs to happen in order for the NFT market to show this growth?

Before going into these questions, it is important to know who is owning or interested in NFTs, before turning towards political and macroeconomic aspects followed by NFT market-specific aspects.

(18) Reuters

(19) Techcrunch

(20) Cryptonews

(21) GlobeNewswire

(22) PRnewswire

NFT investor demographics

Geography: Using data from Google Trends, Statista data shows that the interest in NFTs is highest in East Asia and Oceania: The most interested people live in China, Hong Kong, Singapore and Macao. Taiwan and South Korea are also in the top ten. Apart from Gibraltar, there is no European country among the top ten and Cyprus is the only European country in the top 25. Canada and the US come in on ranks 27 and 40 respectively. The first large European economy is Switzerland, ranking at 46. Europe’s biggest economy, Germany, ranks at 124.(23)

Graph 6: Interest in NFTs by country, top 15 countries

Source: Graph by Statista

In line with that, CashNetUSA(24) found that people from Singapore and Hong Kong are most interested in NFTs – measured by online searches per capita. The rest, however, differs widely: Canada, Iceland, US, Liechtenstein, San Marino, Australia, New Zealand and Malta follow.

With regards to NFT ownership, India leads the way with 7% of people owning NFTs, followed by Vietnam (6%), Hong Kong and Singapore (both 5%), Brazil, Ghana, Indonesia, Nigeria and the Philippines (all 4%). The US comes in on no. 10 (3%), followed by Ireland, Kenya, and Canada.(25)

(23) Statista

(24) CashNetUSA

(25) Finder

Graph 7: NFT ownership by country, top 15 countries

Source: Graph by Finder

Altogether, it seems fair to say that the engagement in NFTs seems to be highest in East Asia, Oceania and North America.

Age: According to Finder data, 18-34 year-olds are most likely to own an NFT in most countries, except for Hong Kong, Vietnam, Ghana and Kenya.

Graph 8: NFT ownership by country, top 15 countries

Source: Graph by Finder

Data by the US Census Bureau for the US is a bit more granular: It shows that 18-24 year-olds are the most engaged age group regarding NFTs. 14 percent are trading NFTs and 18 percent are interested in doing so. They are followed by the 25-34 year age group with 8 percent trading and 11 percent interested.(26)

Gender: According to data by Finder, men are more likely to own an NFT. On average, about 4% of men worldwide report owning an NFT, compared to 2% of women. The gap between men and women is widest in the United States, where 4% of men report owning an NFT, and only 1% of women. The difference is lowest in Japan, where 2% of women own an NFT compared to 1% of men.(27)

Income: Data by the US Census Bureau shows an interesting divide in NFT investments depending on income for the US: People with an annual income of less than 25,000 USD are equally likely to invest in NFTs as those earning more than 150,000 USD annually. Middle-income respondents (25,000 to 150,000 USD) were the least interested, with up to 94% not interested in NFT at all.(28)

(26) Civic Science

(27) Finder

(28) Civic Science

Graph 9: NFT ownership by income group, United States

Source: Graph by Civic Science

It is noteworthy that in the area of crypto currency, investors mostly only invest their disposable income.(29) Of course, this might be different for NFTs. However, it is likely that there is a considerable overlap between traders of NFTs and cryptocurrencies.(30)

Information sources: It is also remarkable that NFT and cryptocurrency investors turn mainly to online sources for their research. According to a study by Strategy&, YouTube, websites, forums and Instagram of the top four sources of information. Also Binance finds that 52 to 60 percent of cryptocurrency investors turn mainly to online sources for research.(31)

(29) Binance

(30) Security.org

(31) StrategyandPwC, Binance

Political and macroeconomic factors leading to the 2022 NFT trading collapse

Looking at The Dotcom bubble helps understand the macroeconomic dynamics. The Dotcom bubble was a speculative frenzy in the late 1990s and early 2000s that saw the rapid rise and fall of many internet-related companies. From 1994 to its peak in March 2000, the Nasdaq stock market index increased by over 10x and subsequently fell by almost 80 percent from its peak by October 2002. Nevertheless, it recovered and grew by almost 100% over the next two years, reaching the levels of early 1999.(32)

Graph 10: Development of Nasdaq 1994-2018.

Source: Graph by Yahoo Finance (retrieved 5 April 2023)

The reasons for the Dotcom bubble and its burst are numerous. Among the most prominent are:

- Technology shift: Investors were excited by the prospect of the web 2.0 revolutionizing industries and creating new opportunities for businesses to grow and thrive. As a result, there was a rush of investment into internet-related companies, many of which had little or no earnings and were operating at a loss.

- Availability of funds: Funding from venture capitalists was easily available due to low interest rates. A lowered top marginal capital gains tax in the United States encouraged individuals to invest in shares, including internet-related companies that were performing very well despite bad traditional metrics such as the price-earnings-ratio.

- Public encouragement: Investment banks encouraged investments in technology companies as they profited significantly from initial public offerings of these companies.

This led to a frenzy of buying and selling of technology stocks, driving up the prices to unsustainable levels. And it came to a strong surge when various events shook that house of cards, for example:

- Japan’s economic outlook for 1999 and 2000 was not positive.

- Mid 1999, the Federal Reserve Bank started to increase their interest rates.

- Warning voices urged a stricter look at corporate key metrics or even predicted that many internet companies would soon file for bankruptcy.

- Yahoo! and ebay ended their merger talks.

- Microsoft was about to lose an antitrust case and saw a sharp decrease in its share price.

(32) Marketwatch, YahooFinance

(33) News-Gazette, Strategic Organization, BusinessInsider retrieved from archive.org, BusinessInsider, Totally wired

(34) JRI, cao.go

(35) Barrons, Bloomberg

(36) CNN

(37) NewYorkTimes

This led to the realization that many Dotcom companies were overvalued and had little or no earnings to support their stock prices. Additionally, many of these companies were operating in an unproven market, with no clear path to profitability. The effect was reinforced by the fact that many employees of technology companies sold their shares directly after their lock-up periods, which led to a further decrease of the share prices.

The similarities with the situation in the NFT market in 2021 and 2022 are uncanny:

Technology shift: The transition from Web 1.0 to Web 2.0 played a significant role in the Dotcom bubble(38) and its aftermath. Web 1.0 was characterized by static, one-way communication where users were primarily passive consumers of content. Websites were often informational in nature and focused on presenting information to users in a static manner. The transition from Web 2.0 to Web 3.0 is still ongoing, but it represents another major shift in the evolution of the Internet and the technology industry. While Web 2.0 was focused on user-generated content and interactive communication, Web 3.0 is focused on decentralization, interoperability, and machine-to-machine communication – and hence driving growth beyond the current levels. Yet, Web 3.0 is still in its infancy and hence Web 3.0 companies are also operating in an unproven market, with no clear path to profitability – just like Dotcom companies in the late 1990s.

Availability of funds: Just like in the late 1990s, in 2021, during the hype of the NFT market, money was easily available. Interest rates were at record lows and venture capital investments at record highs.(39) 2022 was very different, however: After Russia’s invasion of Ukraine in February 2022, energy prices increased strongly due to the war and sanctions.(40) Interest rates followed shortly thereafter, in an attempt to curb inflation.(41) As a result 2022 saw a strong decline in venture capital funds.(42) Moreover, private consumption decreased(43) and along with it most likely also the willingness to invest into NFTs as disposable incomes (that investors mostly started to deteriorate. Especially, the investor group earning less than 25,000 USD annually, is likely to slow down or stop trading as their disposable income will deteriorate most due to inflation.

Public encouragement: Also during the NFT hype, there was a lot of public encouragement. This aspect will be discussed in the next chapter.

This (admittedly superficial) look at the political and macroeconomic environment suggests that these aspects might have played a notable role in the NFT market decline. Hence, it is not unlikely that the market recovers once these macroeconomic factors improve.

However, a closer look at Graph 1 reveals that the number of NFT sales and active market wallets already started to decrease months before Russia’s invasion of Ukraine. This trend was only accelerated by the political and economic developments after February 2022. In line with that a study by Strategy& shows that 36% of German cryptocurrency and NFT investors had already reduced their investments in Q4 of 2021.(44) Hence, not everything can be explained by macroeconomic factors. NFT market-specific aspects will be discussed in the following chapter.

(38) Bankrate

(39) DW, Factset

(40) ECB

(41) Reuters, NewYorkTimes

(42) Deloitte

(43) CrunchBase

(43) StrategyandPwC

NFT market-specific aspects leading to the 2022 NFT trading collapse

What needs to happen in the NFT space in order to get back on the growth track? Factors suspected to prevent NFT mass adoption are:(45)

- Accessibility: It is tedious to trade NFTs because it requires a certain level of technical understanding and skill.

- Scalability: In some cases the blockchain technology was unable to handle the high market demand.

- Environmental impact: It takes a high amount of energy to run blockchains.

- Real life utility: Often, NFTs do not play a role in people’s real (offline) lives – or their virtual lives do not play a big enough role in their lives as a whole.

- Security: NFTs can get (and already got) stolen when the smart contract security is inadequate.

- Fraud: NFTs get faked, illegally minted from someone else’s artwork, or sold in fake NFT stores.

- Valuation: There is a lot of uncertainty in determining the fair price of an NFT.

All of them are reasonable barriers to NFT adoption beyond the levels of 2021. But not all of them are likely the reason for the sudden decrease in NFT trading in 2022, as a closer look reveals:

Accessibility and scalability

It is apparent that problems with accessibility and scalability did not prevent people from trading in 2021. Hence, the lack of access or technical scalability cannot be causal for the sudden drop. Nevertheless, it is not unlikely that the strong surge in NFT prices motivated NFT investors to accept the fact that trading NFTs is tedious in return for extraordinary profits. When the market declined, generating profits became increasingly hard, which might have been a reason to slow down or stop trading. This is underpinned by the fact that some NFT investors are so-called ‘flippers’ trying to buy low and sell high quickly.(46) And it would also be in line with OECD data from the Asian cryptocurrency market: The most important reason to trade cryptocurrencies is to “make money quickly”.(47) And while this might not be the same for NFTs, it is likely that there is a considerable overlap between traders of NFTs and cryptocurrencies.(48)

Altogether, it seems likely that improved accessibility and scalability will increase the NFT market growth. Technical and usability innovations will help to do so. However, it seems unlikely that problems with accessibility and scalability were an important reason for the surge in NFTs and are a main driver to recover from the crisis.

Environmental impact

There is very little data about how important environmental aspects are for NFT investors. However, concerns about the environmental impact of cryptocurrency increased among investors, journalists, academics and policy makers. While this did not specifically mention NFTs, it suggests that there is a growing awareness about the environmental cost of blockchain-based technologies. The environmental impact of NFTs specifically has also been a topic of discussion and debate, during which several artists and art fans have expressed concerns about the environmental impact of NFTs, to the point where companies canceled their plans to launch NFT businesses after a public outcry for environmental reasons. As awareness of the environmental impact of NFTs has grown, one might speculate that investors have become more hesitant to buy and invest in NFTs, which could contribute to the decline in demand.

However, the timing speaks against it: In May 2021, Ethereum announced that it will reduce its energy consumption by 99.9 percent through changing from a proof-of-work to a proof-of-stake mechanism. However, as mentioned before, the number of NFT transactions on Ethereum dropped by over 90 percent between May and September 2021 – so after this announcement.

Moreover, while there is a public debate about it, ecological considerations do not seem to play a big role for crypto currency and NFT investors. Recent studies about their attitudes and behaviors do not even touch upon this topic.

Altogether, concerns about the environmental impact of NFTs might have played a role, but are unlikely to be an important driver.

Real life utility

The time spent online and gaming has significantly increased during the COVID-19 lockdowns, which means that – in absence of real life encounters – the digital life became more important to many. Interestingly, over 75% of e-sports fans are interested in NFTs. Accordingly, real life utility of digital assets is likely to have increased during the COVID-19 lockdowns as people’s online lives played a bigger role than ever before.

What about the timing? The first lockdown in Wuhan, China, started in January 2020. Globally, most of the lockdowns happened in 2020 and 2021, only very few were still imposed in 2022. The hype around NFTs rather suddenly started mid 2021, the decline started in the beginning of December 2021 and accelerated in February 2022 (see Graph 1). This seems to be consistent with the idea that more time online results in more engagement with NFTs: One could argue that in 2020 people spent time online in a ‘usual way’ (websites, social networks, gaming, etc.) and after a while extended their activities to such things like NFTs. This is in line with research showing that the most important sources of information are social media, websites and forums. In any case, many people did presumably have more time to invest into NFT research and trading during lockdowns as meeting people outside their household was not an option.

However, it should be mentioned that the hype around NFTs began only shortly after artist Beepl sold “Everydays: The First 5000 Days”, an NFT-linked digital collage for 69 m USD on March 11, 2021. This might be a coincidence, but also hints towards other motives like investors’ greed that caused an ‘NFT gold rush’.

Altogether, real life utility seems to be a considerable driver of NFT investments. The return of a ‘normal life’ without lockdowns in 2022 might have contributed to a reduced interest in NFTs. This is in line with the fact that from May to November 2022, China was the country with the highest interest in NFTs (see NFT investor demographics), a time when only China still imposed large-scale lockdowns.

Security, fraud, and valuation concerns

Security, fraud, and valuation concerns remain as potential drivers of the surge-and-collapse starting in 2021. All of them essentially come down to a lack of trust and reliable information. Given the macroeconomic dynamic in 2022 and the presumed decrease in disposable income resulting from that, it is likely that the importance of these aspects has increased during that time. As it will remain a problem also in more prosperous times, these aspects will be the focal point of this discussion paper.

In connection with security, fraud, and valuation concerns, this paper argues in favor of two important reasons for NFTs’ surge-and-collapse in 2021-2022:

- Deal Fever: FOMO combined with the lack of structured information and exchange about NFTs makes the market vulnerable to single news and hence high price and activity volatility.

- Fraud: Fraudulent business practices seem to have been ubiquitous and have likely reduced the trust into the market.

It is impossible to prove this hypothesis without directly asking people that pulled out of the market, but the argument can be underpinned by the following observable indicators and logic.

(45) Cointelegraph, NFTify

(46) Colormatics

(47) OECD

(48) Security.org

(49) See for example: Morgan Stanley, New York Times, CNBC, Columbia University, White House

(50) See for example: Wired, TheVerge, ArtNews, CNN

(51) Ethereum

(52) OECD, Binance, StrategyandPwC

(53) Pew Research, Frontiers, DAK, PubMed, WEF, Forbes

(54) Codeless

(55) AP News

(56) Wikipedia

(57) Binance, StrategyandPwC

(58) Yahoo Finance, Entrepreneur

Deep Dive: Deal Fever

Deal Fever can be characterized as “going forward with a deal without performing enough analysis and due diligence beforehand. Getting enthralled in the excitement of a potential deal can either lead to you making a bad deal or paying too much. (It) is all about pursuing the end goal at all costs instead of thoroughly looking at the means, and fully evaluating whether the deal will be good (…)”(59)

A key driver of Deal Fever in the NFT space seems to be the fear of missing out, or ‘FOMO’. This is “the feeling of apprehension that one is either not in the know or missing out on information, events, experiences, or life decisions that could make one’s life better.”(60)

In order for FOMO to happen, NFT market participants would first of all have to be influenced by others. This can be supported by the fact that the crave for NFTs differs by location, as a recent study of CashNetUSA found.(61) Hence, it is likely that the crave for NFTs is a social construct, i.e. it is influenced by a person’s media consumption or social contacts, be it in real life or online. This was presumably also fueled by high-profile celebrities embracing NFTs, such as musicians and sports stars(62) as well as the widespread use of social media influencers promoting NFTs.(63)

(59) Dealroom

(60) Wikipedia

(61) CashNetUSA

(62) Harvard Business Review

(63) SocialSamosa, TokenizedHQ, Jennifer Kate

Influencers deserve a closer look:

Next to NFT creators that promote their artwork, influencers also play an important role in the NFT space. They are either selling their NFTs or allow NFT creators to promote their work to a broader audience by tapping into existing communities.(64)

(…) influencers have an outsized impact on the NFT space. Equally as important as the artists and creators themselves are the celebrities, curators, marketplace owners, and tastemakers who promote NFT projects on YouTube, Instagram, Discord, and, of course, Twitter (…).

Decrypt (65)

(T)hey can be the decisive factor between a successful or failed launch.

TokenizedHQ (66)

Often, people follow them for advice and guidance on how to navigate the NFT market. Hence, NFT influencers do not only leverage their reach, but also their credibility and trust with their followers. But what earns them trust?

- Their reach on social media (working as social proof),

- The belief that they have above-average experience or success in collecting or investing in NFTs,

- The ability to break down complex topics into simple and actionable insights that inexperienced users can understand.(67)

So trustworthiness is key. However, concerns have been raised regarding that. It has been criticized that they merely give buying advice instead of substantially examining and criticizing the art work.(68) On top of that, their advice in some cases seems to be more driven by their personal interest than that of their followers:

A common criticism of NFT influencers is that they are paid to promote projects that they never actually vetted properly, often leaving behind disgruntled investors. (…) Some of the biggest influencers fail to do proper due diligence and will promote nearly anything for money. And what’s even worse is when they do so in a concealed way.

TokenizedHQ (69)

As payment is frequently made in the form of free NFTs, influencers have a vital interest in hyping certain NFTs rather than giving solid advice.(70)

Does all of this lead to FOMO? Various publications(71) indicate that FOMO seems to have been a serious issue in the NFT space – to the point that even help guides have been published online(72) or businesses are bearing the term “FOMO” in their names.(73)

The whole market is driven by FOMO and Hype.

Rikam Palkar (74)

The feelings of greed, fear, and anxiety have reached their peak in NFT investing and need to be addressed. People are investing in NFTs with money they can’t afford to lose and with the hopes that empty promises lead to execution.

Ty Herrenbruck (75)

(64) Ibidem

(65) Decrypt

(66) TokenizedHQ

(67) TokenizedHQ, Jennifer Kate

(68) Monopol-Magazin

(69) TokenizedHQ

(70) The fact that Meta pulled out of NFTs might change their role, but this remains to be seen.

(71) For example: Ebutemetaverse, TechCrunch, CyberScrilla, Nefture, Patlid

(72) Ebutemetaverse, Patlid, Ledger

(73) FOMOlab, thatFOMOisreal

(74) Rikam Palkar

(75) Ty Herrenbruck

As commentators of the NFT space utter, the NFT hype was driven by the wish to get rich quickly:

Of course, it’s hard not to get hyped by a get-rich-scheme where so many actually have gotten rich quick: with so much vapor changing hands for so much money, you can’t spell NFT without FOMO.

CashNetUSA (76)

We’ve had amazing stories of rags to riches come ups, people pulling themselves and their families out of crippling debt, and others making a significant impact in their communities.

NFTnow (77)

And FOMO seems to be consciously instrumentalized by businesses:

Projects will create a reality where they are, without a doubt, the next “blue chip.” They will convince you that they will sell out immediately and reach the moon in a beat. They’re the chance of a lifetime for you. They’re the project that will make all your dreams come true.”

Nefture (78)

Because 99% of NFT & Crypto projects are built to create FOMO, and many of them are VERY GOOD at it! Which creates the perfect environment for scammers to successfully scam you.

Nefture (79)

This anecdotal evidence suggests that the NFT space was characterized by a trader mentality (looking for short term gains from price fluctuations), rather than an investor mentality (looking for long term gains from investing in assets that are sold below their ‘inner value’). This argument can be underpinned by the fact that important drivers of ‘value’ have not materialized yet. Forbes defines value as follows:

Value = Scarcity + Utility + Reputation + Liquidity (80)

(76) CashNetUSA

(77) NFTnow

(78) Nefture

(79) Nefture

(80) Forbes

Scarcity is a dilemma for creators, owners and businesses since scarcity is necessary to make art valuable, but at the same time limits growth.(81) So value and explosive growth as it has been seen in the NFT space are a paradox. However, this could be alleviated by an increase in demand and real-life utility, for example through substantial growth of the metaverse, which could create a surge in demand for NFTs. This, however, is still in its infancy.

While Gartner predicts that 25 percent of people will spend at least one hour per day in the Metaverse by 2026(82), real-life utility of NFTs is still low for the majority of applications. As long as digital art and metaverses are things mostly imagined to be mass-adopted in the future (instead of being so now), assets for such occasions will remain an investment based on speculation on their real-life utility in the future.(83) On top of that, the use of the Metaverse might in some instances be possible only through local monopolists – like gaming companies or hardware providers (e.g., virtual reality goggles).

In addition, the NFT market is a place of high pace and uncertainty, which is hard to keep up with, even for professionals:

There’s a running joke within the industry that days in web3 are like months in the web2 world. As exaggerated as it seems, it’s also true. No matter how hard you try, it’s impossible to keep up with all of the information.

NFTnow (84)

On top of that, especially at 2021 prices, a lot was at stake. Prices of NFTs were skyrocketing and in many cases barely affordable.(85)

Life-changing sums of wealth can be made, lost, or stolen overnight.

NFTnow (86)

As a result, the NFT space is “an industry fueled by FOMO, FUD, luck, and deep emotions.”(87)

All of that comes in combination with the fact that there are very few guidelines on how to determine the ‘inner value’ or a fair price of an NFT. Unlike regarding the evaluation of stock prices or companies, there is neither technical analysis, nor a mathematical scheme to determine the ‘inner value’ of art, let alone digital art. The value of NFTs is a social construct. Anyone can assign any value to it. Hence, “people can’t determine the factors that might drive the price of NFTs. Due to this, the fluctuations in prices remain constant, and evaluation of NFT becomes a big challenge.”(88)

Given this evidence, it seems fair to conclude that the NFT space in 2021 suffered from Deal Fever.

(81) Spiceworks

(82) Gartner

(83) Forbes, Cointelegraph, NFTify

(84) NFTnow

(85) ChainWitcher, NFTnow

(86) NFTnow

(87) ibidem; “FUD” is an acronym for “fear, uncertainty and doubt”

(88) Geekflare

Deep Dive: Fraud

Fraud is ubiquitous in the NFT market(89) and it can happen on the individual level or as a market manipulation. On the individual level, scammers trick individual people into revealing their wallet details (phishing scams, customer support impersonation, airdrop scams) or selling their NFTs at very low prices (bidding scams).(90) The bigger problem seems to occur on a market level, though: As the NFT market is relatively small, it is prone to manipulation.

- In Rug-Pull scams, fraudsters hype a specific NFT (often through social media) but disappear after receiving funds from NFT investors – as happened in the ‘Frosties’ case.(91)

- Similarly, in NFT investor scams, developers hype an entire NFT project and disappear after receiving funds from venture capitalists or other investors – as happened in the ‘Evil Ape’ case.(92)

- In pump-and-dump schemes, scammers artificially inflate NFT prices by misrepresenting the asset and spreading misleading information about it – in order to sell it at the inflated price and also vanish right after the sale.

- When selling plagiarized NFTs, fraudsters sell fake NFTs as originals and the NFT price plummets after the plagiarism becomes known. The problem is huge: In January 2022, OpenSea tweeted that more than 80 percent of NFTs minted using its minting tool were fake.(93)

- Wash trades are a market manipulation, in which an investor sells and buys the same assets in order to create misleading, artificial activity and prices in the marketplace. Wash trading patterns seem to be ubiquitous in the NFT space. Two examples:

- End of 2021, a Crypto Punk #9998 sold for 532m USD, a mind-boggling number even compared to the already high prices that Crypto Punks typically yield. The person who bought it, bought it from itself – presumably to inflate prices or to gain publicity.(94)

- In January 2022, the NFT market unexpectedly grew by 129 percent month over month. Much of the increase was due to the newest competitor on the NFT marketplace scene: Looksrare. The marketplace was only launched on January 10 and had already generated a volume of more than two billion dollars in its 19 days of existence.(95) CryptoSlam estimates that more than 8.3 bn USD worth of wash trades have been made on the market place, the vast majority of its sales volume to that date.(96)

To be fair, scams also exist in other asset classes than NFTs. However, other asset classes, such as the markets for stocks, bonds or real estate, are more heavily regulated and have stricter disclosure requirements: They for example require regular financial statements, prospectuses, land registers, notaries, etcetera. In contrast to that, NFT investors are not only facing scams. They also struggle to find all the necessary information about an NFT. There are platforms showing details of NFTs and helping evaluate them (e.g. Etherscan, NonFungible, NFTpricefloor, rarity.tools), but these information are very basic and make it hard to identify fraudulent patterns.

(89) Forbes, inews, TheVerge, The Guardian

(90) Cloudwards, NFTically

(91) Justice.gov

(92) The Crypto Times

(93) Twitter

(94) InfluencerMarketingHub

(95) The Block, t3n

(96) Decrypt, Twitter

Implications for the future of NFTs

In order to become a fully functioning market, the NFT space lacks not only better technology for aspects like improved accessibility, scalability and security. It requires a corrective to counter deal fever and fraud and replace it by trust and price stability. How can this be achieved? Through the collection, generation, condensation and simple display of data that is reliable and relevant for valuation.

- In a world of ‘socially assigned value’ and a lack of mathematical schemes to check the ‘inner value’ of an item, social checks and balances might be the only adequate way to prove or disprove the alleged value of NFTs. As opposed to sellers that are very good at creating FOMO, buyers don’t seem to have much of a voice in the market. They compete with each other for the best deals rather than collaborating in order to identify FOMO or fraudulent patterns. Hence, they are exposed to the risk of being scammed or ripped off by FOMO-induced overpricing. In the future, they should have joint forums in which they support and inform each other about certain aspects of NFTs.

- As the NFT space is hard to oversee, NFT investors need data about the ‘socially assigned value’ of an NFT. This could be drawn from the currently known sources as well as the forums mentioned above.

- This data needs to be enhanced by fraud prevention data. Unlike ‘socially assigned value’ this can probably be inferred from technical data such as the number and frequency of trades, the trustworthiness of the wallets that have been involved, persistence of price levels (lack of outliers), comparing trading volume to social media metrics, fraud detection indicators in social media profiles, transparency on press coverage on fraudulent patterns or scandals, etcetera.(97)

- This data needs not only be available. It must also be

- Condensed (ratings, scores, etc.),

- at hand at low costs (free of charge, available from a few places), and

- have a low likelihood of being displayed in a manipulative or hyped way.

What are appropriate means to this end?

- Decentralization: The technical tools are already at hand. Blockchain technology is ideal to create the necessary trust – by making the data public and hard to manipulate.

- Democratization: The organizational tools are also at hand. In order to avoid the manipulation by a well-informed centralized entity (such as influencers, creators or companies) at the expense of the uninformed crowd, the collection, generation, condensation and display of relevant data can be done by a decentralized autonomous organization (“DAO”).(98) In such a DAO, decisions are made publicly and with the participation of all token holders, which effectively prevents manipulation.

To sum it up: It is likely that deal fever and fraud are the main drivers of the surge-and-collapse in 2021-22. In order to prevent that from happening again, a social corrective is required. Collecting, generating, condensating and displaying reliable and valuation-relevant data on a decentralized ledger of a democratic entity seems to be the most promising way to do so. The NFT community should work on making this happen.